Key Takeaways

- Legal entities that pool multiple investors into one are called Special Purpose Vehicles (SPVs)

- Startups have three main options: VC-led SPVs, "entity-only" solutions, and founder-led SPVs

- Vehicles can save companies $50K-$100K+ in legal and admin costs vs taking individual investments

For startups, raising capital from many value-add investors is one of the best ways to increase your odds of success. It's also one of the fastest ways to create cost, complexity, and risk that slows you down later.

That's why the startup ecosystem has started using legal entities to contain the complexity of involving many investors. These entities are generally referred to as "vehicles", "Special Purpose Vehicles", "SPVs", "Founder SPVs", "Roll Up Vehicles", or "RUVs", depending on the context.

Used well, these investment vehicles can save your startup time and money:

"It felt like we were managing one check instead of 50. Founders looking to simplify their logistics while raising money from a lot of great angels should use [them]."

But used poorly, they can tie the startup and the founder to unnecessary fees, hidden risks, and administrative burdens.

This guide breaks down what these vehicles are, why companies use them, and the tradeoffs between the different options.

What Is a Special Purpose Vehicle?

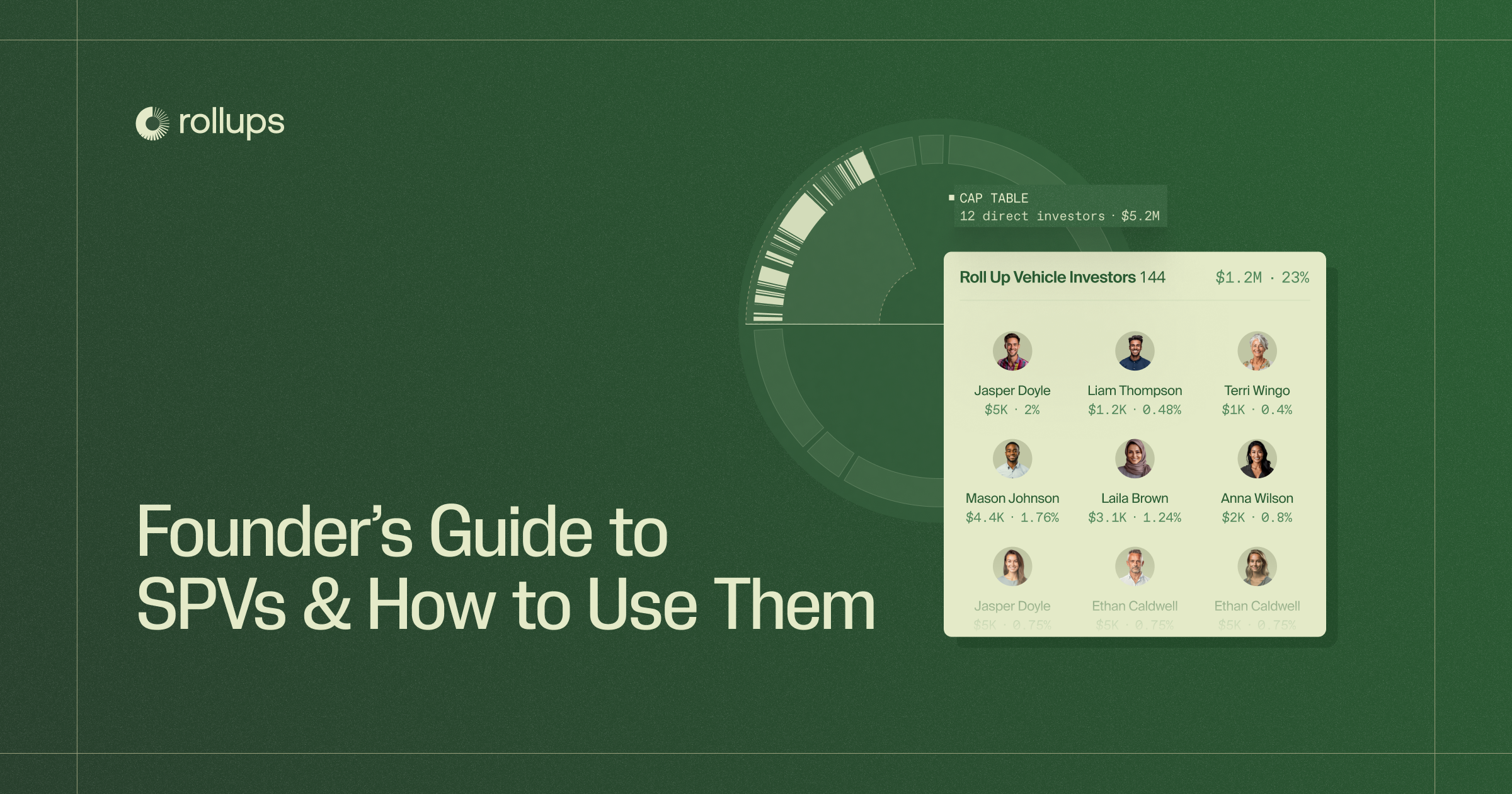

A special purpose vehicle (SPV) is a legal entity formed to make one investment. The typical SPV "lifecycle" is:

- Up to 250 investors contribute capital into one SPV.

- The SPV invests that pooled capital into your startup.

- In exchange for the capital, the SPV holds one SAFE, note, or share issuance.

- On your cap table, you see one line item for the vehicle (instead of dozens of individual investors).

- Investors in the SPV hold an interest in the vehicle (not the actual shares in your startup).

The Challenges of Taking Direct Investments

For startups, taking direct investments from many investors appears straightforward, but creates several challenges:

- Cap table clutter. 20+ small shareholders signals “messy” to future VCs.

- Slower rounds. Every investor signature is another delay in closing.

- M&A friction. Buyers don’t want to add many rows to their own cap tables.

- Governance headaches. More investors means more approvals for key actions.

- Missed opportunities. Founders sometimes skip strategic investors just to avoid the mess.

"We signed over 30 SAFEs to raise initial funds. We feared chasing down all of those investor signatures in future financings."

"The potential lead in my round brought up that my cap table looks crowd-funded."

Vehicles solve these problems by "containing" many investors in one row on the cap table, keeping your cap table clean while still letting you include the investors you want.

Your Options for Investment Vehicles

When founders consider using a vehicle, they generally have four options:

1. Do nothing (take direct checks, skip the vehicle)

- How it works: Each investor invests directly in your company.

- Pros: No intermediary, no upfront costs.

- Cons: Messy cap table, higher lifetime costs, slow diligence, hard governance.

- Best for: Very small rounds (1–3 investors).

2. Find a VC or 3rd party to create and lead an SPV into your startup

- How it works: A VC or GP (general partner), external to the startup, sets up and manages the vehicle.

- Pros: Clean cap table, professional structure.

- Cons: The VC now controls an entity on your cap table, and you see less of the capital because they charge investors fees (can be 2% management fee and 20% carry).

- Best for: Raising from investor groups you wouldn't have access to without the VC, where you’re comfortable with a GP being in the mix.

3. Use a vehicle created by a law firm or "entity-only" SPV provider

- How it works: A law firm or certain SPV providers form an entity and transfer ongoing responsibility to the startup.

- Pros: Consolidates investors to one line item. Typically lower upfront costs.

- Cons:

- Service often ends after vehicle creation or document execution. Ongoing tax and compliance (K-1s, filings, distributions) become the founder's responsibility or require hiring additional third-party services.

- Limited investor experience—basic document signing, inconsistent accreditation verification, minimal support.

- No formal advisor to the vehicle. Responsibility and potential conflicts remain with the founder.

- Best for: Limited scenarios where founders willingly accept ongoing responsibilities and risk.

4. Vehicles started and led by the company (such as an RUV).

- How it works: The startup creates the vehicle (without needing a VC to get started or lead it) while a software platform (like Rollups) handles filings/administration, provides investors with a seamless online investment experience, and manages tax compliance (K-1 preparation and distribution).

- Pros:

- Clean cap table with one line item.

- Turnkey solution for a one-time fee only due when you're done raising.

- Full-service investor onboarding (white glove assistance, accreditation/KYC, and tax).

- Platform-advisor included. The platform's advisor, not the founder, is responsible for making material decisions for the vehicle so the founder is not exposed to undue risk and conflicts.

- Cons:

- Must source your own investors.

- Best for: Any round with 5+ angels where you want a clean, low-risk structure.

Cost & Risk: Side-by-Side Comparison

Here's how a $500K raise from 20 angels compares:

| Structure | Capital Invested | Capital Reaching Company At Close | Entity Risk for Founder | Long-Term Risks |

|---|---|---|---|---|

| Direct checks | $500K | $500K | N/A (no entity) | Slower rounds, harder M&A |

| Traditional SPV | $500K | ~$485K (after investors pay SPV admin fees and 1% management fee to GP) | Low (GP assumes role) | GP tied to your company forever |

| Law firm / Entity-only SPV vendor | $500K | ~$400–450K (fees billed hourly + separate annual compliance + 3rd-party tax services) | High (no advisor- responsibility flows back directly to founder) | Founder stuck managing tax, filings, disputes |

| Roll Up Vehicles (company-led vehicle) | $500K | $500K (flat fee paid by company, only at close) | Low (platform-provided advisor assumes role) |

Final Thoughts

Investment vehicles have become an essential tool for startup fundraising. They solve many problems founders face when raising from multiple investors - from cap table complexity to administrative overhead.

The key is choosing the right structure. Each option comes with different tradeoffs in terms of control, cost, and complexity. Here are some key questions to ask providers while picking a solution for your startup:

- Do you formally advise the entities you create to de-risk this for me and my startup?

- Who handles K-1s, tax filings, and compliance? Are you outsourcing this? What are their fees?

- What will my costs be in year 2? Are there any hidden fees?

- What is the investor experience like?

Founders who have used Roll Up Vehicles:

"Everything just worked. Our investors loved the simplicity, and I loved that I could bring in the right people without creating a cap table nightmare."

"The Rollups team provided excellent service in the RUV process — professional, fast, and reliable. In moments when founders feel lost, they brought clarity."

"RUVs made it easy for our UK-based company to raise $1M+ from investors, regardless of where they were."

"We used AngelList RUVs to get great people onboard without the typical admin overhead of a large cap table. Incredible experience for founders & investors."

"We signed over 30 SAFEs to raise initial funds. We feared chasing down all of those investor signatures in future financings. Our investors were happy to execute the Rollup, saving us ~$20k and ~2 weeks."

Ready to Launch Your RUV?

If you're a startup looking for an investment vehicle for your next round, Roll Up Vehicles are the only solution built specifically for you.

Get started today:

- Visit rollups.com/ruv to launch your RUV

- No upfront costs or commitments required

- Join the thousands of companies that have raised with RUVs

FAQ

What is a Roll Up Vehicle and how does it differ from a traditional SPV?

A Roll Up Vehicle (RUV) is a type of SPV designed specifically for companies and founders. Unlike traditional SPVs run by external VCs/GPs who charge investors fees and carry, RUVs are founder-led, do not charge investors fees/carry, are professionally managed and advised, and have no ongoing fees.

How much does it cost to set up an RUV for my startup?

RUVs have no upfront setup costs and no ongoing management fees or carried interest. Companies pay a flat fee only when they're done raising.

What's the minimum and maximum amount I can raise through an RUV?

There's no upper limit on RUV fundraising. Companies have raised anywhere from $50K to $100M+ through RUVs. The minimum is typically $1K, but this depends on your specific investor group and round structure.

How long does it take to set up and close an RUV?

Most companies launch their RUV in minutes and, once ready, can close the capital raised in 1-2 days. The streamlined process eliminates the weeks or months typically required for traditional SPV setup and management.

Can international companies use RUVs to raise from US investors?

Yes, RUVs support both US companies raising internationally and international companies raising from US investors. The structure provides cross-border investment capabilities with built-in regulatory compliance.

How do investors view RUVs compared to direct investments?

Your lead investors/VCs will prefer investing directly into your company, but for follow-on VCs and smaller investors, they love RUVs because they provide a familiar, professional investment experience powered by their AngelList wallets. There's no additional complexity for investors - they simply invest through their existing AngelList accounts with the same protections and reporting they expect.