Highlights

- Raise from angels, advisors, strategics, friends, family — while showing just one line on your cap table.

- Save on legal fees, close faster, include strategic small checks without the admin burden, and keep your cap table clean for future investors.

- RUVs can invest for SAFEs, equity, convertible notes, or warrants — use them to streamline rounds at all stages

- Works for US and non-US companies, and supports global investors

- Rollups handles the setup and management of the RUV — powered by AngelList

You don’t need to manage 100 investors to raise from 100 investors.

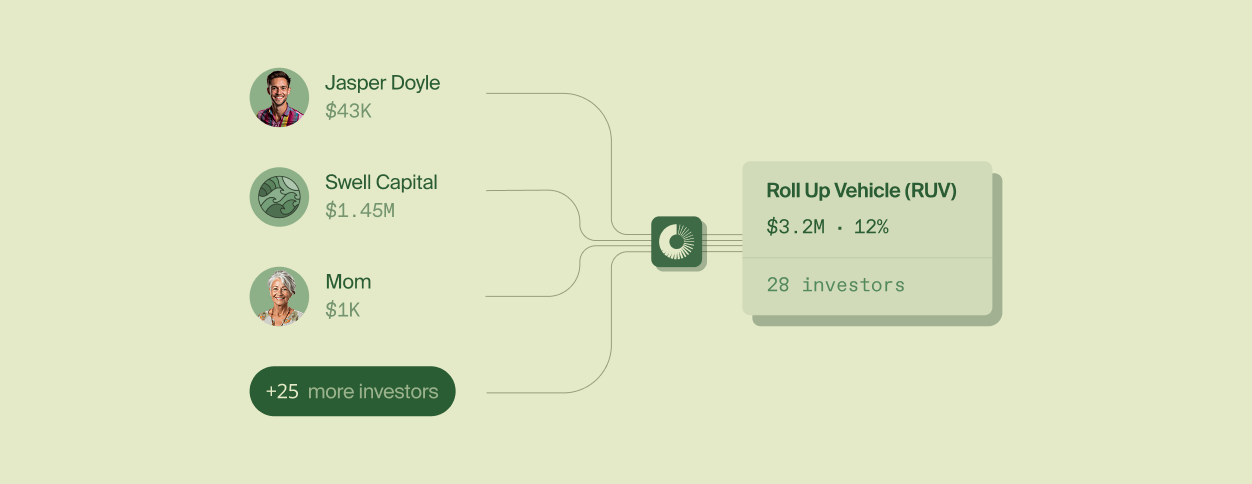

Roll Up Vehicles (RUVs) help companies pool many investors into one professionally managed entity on their cap table. Whether you are onboarding 10 investors or 250, RUVs consolidate them into a single line item — backed by a vetted structure that has helped companies raise over $1B, and built for speed and compliance.

What is an RUV?

RUV is a type of Special Purpose Vehicle (SPV) purpose-built by Rollups and powered by AngelList. It allows companies to raise capital from many investors through a single, compliant structure — without needing to close each investor individually.

Investors purchase interests in the RUV, which in turn invests in the company’s instrument — whether a SAFE, equity, convertible note, or warrant.

RUVs are fully managed by Rollups and powered by AngelList’s infrastructure, which supports over $171B in assets for top-tier venture funds and companies. Unlike traditional SPVs — which often require founders or company executives to act as the vehicle’s manager or general partner — we handle administration, compliance, investor onboarding, and post-close support while proxying the vehicle’s votes to the founders to maintain control.

Why Use an RUV?

✓ Raise from many. One cap table entry: Pool dozens of investors — angels, advisors, strategics — into a single, clean line on your cap table.

✓ Fully managed by Rollups, powered by AngelList: We handle setup, investor onboarding, compliance, fund collection, and lifetime admin — including tax filings, distributions, and reporting.

✓ Accept small checks without admin friction: Onboard investors through a simple, secure digital flow — no chasing signatures or wires.

✓ Faster closes, lower costs: Launch in minutes and close in days. Flat fee pricing, payable at close, with no fees for investors.

✓ Keep control: RUVs proxy voting rights back to the founder, so you maintain control of key decisions.

✓ Include strategic investors: Easily bring in angels, advisors, or customers — without cluttering your cap table or slowing things down.

How Founders & Companies Use RUVs

RUVs are flexible. Companies use them for far more than just standard rounds:

- Off-cycle capital: Raise on uncapped SAFEs or top-ups post round closure, to keep momentum going.

- Advisors: Pool warrant or equity grants into a single vehicle.

- Customers: Let high-value customers invest while preserving cap table clarity.

- Incorporation: Bring in early believers or previous-venture supporters at formation stages with nominal amounts

- International: US companies use RUVs to raise from global investors. International companies use RUVs to pool US (and global) investors via a compliant structure.

Without RUVs: Hidden Costs Add Up

Fragmented cap table creates downstream friction:

- Legal overhead: Dozens of docs, signature chases, and administrative deadweight.

- Slower diligence: Messy cap tables signal risk and increase time to close future institutional rounds.

- Consent chaos: Collecting approvals from 50+ individuals can stall deals, M&A or key decisions.

Companies often underestimate the cost of managing individual investors — or worse, skip strategic small checks to avoid the admin. RUVs eliminate that tradeoff.

Company & Investor Outcomes with RUVs

Here’s what we have seen:

-

$50k-100k+ saved on legal and admin costs by consolidating 20+ investors into one structure — contributing to the $100M+ saved collectively by companies using RUVs.

-

Faster closes: Rounds that may have taken 3–4 months, complete in under a week.

-

Institutional-ready cap tables: A single line item helps keep follow-on rounds efficient.

-

Value-add upgrade: RUVs make it possible to include strategic advisors and supporters with small checks — without added complexity.

-

QSBS-friendly: RUVs generally preserve any QSBS eligibility for underlying investors.

"We used an RUV to raise ~$10M from our non-lead investors. The platform was intuitive — for both us and our investors, including those contributing seven figures. The support team was professional, responsive, and knowledgeable throughout. Looking back, this approach could have saved us a lot of time and complexity in earlier rounds. We’ll definitely be using RUVs in future rounds."

How RUVs Work with Rollups

Rollups manages your RUV setup & management. AngelList powers the underlying vehicle, onboarding flow, and fund operations.

Here’s the typical process:

-

Phase 1: Launch (Days 1-2)

- Complete the RUV application (~5 mins)

- Rollups sets up your RUV (same-day turnaround)

-

Phase 2: Investor Onboarding (Days 2-28; or up to 6 months)

- Generate custom invite links for investors

- Share links with your investors and monitor status via your dashboard

-

Phase 3: Closing (Days 29-30; or last 1-2 days)

- Complete the Closing Checklist (~5 mins)

- Rollups completes closing review, signatures and deploys funds (1-2 days)

Post-close, Rollups and AngelList handles ongoing administration, tax, and distribution support for the RUVs lifetime.

Let’s Simplify Fundraising

Fundraising is hard enough — managing dozens of investors shouldn't make it harder.

RUVs make it easy to include your community, advisors, angels, investors and customers — while keeping your cap table clean and admin light.

Want to see if an RUV makes sense for your next round? Book a free consultation.

Frequently Asked Questions

What is a Roll Up Vehicle (RUV)?

A Roll Up Vehicle is an investment structure that consolidates multiple angel investors into a single line item on your cap table. Instead of managing many individual investor relationships, startups deal with one entity while still accessing the strategic value of all investors.

How much can an RUV save in administrative costs?

Companies typically save $50k–$100k+ of legal, admin and vendor costs over their lifetime by consolidating investors through an RUV.

What are the main benefits of using an RUV for fundraising?

RUVs eliminate administrative overhead, simplify cap table management, reduce legal complexity, and allow founders to focus on building relationships rather than paperwork. They're particularly valuable when you want to include many strategic investors who can provide expertise beyond capital.

How long does it take to set up an RUV?

Most companies launch within minutes and can close capital in days.

Which investment instruments are supported?

RUVs can invest via SAFEs, priced equity, convertible notes, and warrants — making them useful at all stages.

Is there a limit to how much I can raise from an RUV?

No. There’s no upper limit. Depending on your company’s capital needs, stage, and investor demand, you can allocate any amount to an RUV. Companies have raised anywhere from $50k to $100M+ through RUVs.

Can I start an RUV for free?

Yes, companies can setup and launch an RUV for free. Payment is made later, when the RUV closes. There is no payment obligation to get started, and there is no cost for cancelling the RUV before closing.

I want to start my RUV right now. Where do I go?

Type ruv.new into your browser, or click Get Started above.